A Quote by George Soros

At times of recession, running a budget deficit is highly desirable. Once the economy begins to recover, you have to balance the budget. But it will also need additional revenues. Should the government not receive them, we will all get punished with higher interest rates.

Related Quotes

A tax cut means higher family income and higher business profits and a balanced federal budget....As the national income grows, the federal government will ultimately end up with more revenues. Prosperity is the real way to balance our budget. By lowering tax rates, by increasing jobs and income, we can expand tax revenues and finally bring our budget into balance.

It is a paradoxical truth that tax rates are too high and tax revenues are too low and the soundest way to raise the revenues in the long run is to cut the rates now Cutting taxes now is not to incur a budget deficit, but to achieve the more prosperous, expanding economy which can bring a budget surplus.

Budget deficits are not caused by wild-eyed spenders, but by slow economic growth and periodic recessions. And any new recession would break all deficit records. In short, it is a paradoxical truth that tax rates are too high today and tax revenues are too low, and the soundest way to raise the revenues in the long run is to cut the rates now.

Our practical choice is not between a tax-cut deficit and a budgetary surplus. It is between two kinds of deficits: a chronic deficit of inertia, as the unwanted result of inadequate revenues and a restricted economy; or a temporary deficit of transition, resulting from a tax cut designed to boost the economy, increase tax revenues, and achieve -- and I believe this can be done -- a budget surplus. The first type of deficit is a sign of waste and weakness; the second reflects an investment in the future.

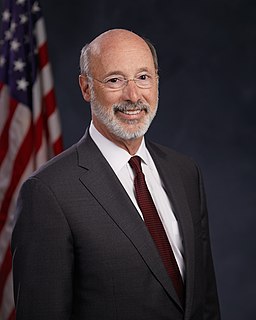

Pennsylvania is facing challenging economic times, a multi-billion dollar budget deficit, and negative cash flow projections. My Budget Deficit and Fiscal Stabilization Task Force will get to work to determine the scope of the challenges facing Pennsylvania and begin to discuss how we can get Pennsylvania's fiscal house in order.

Our true choice is not between tax reduction on the one hand and the avoidance of large federal deficits on the other. It is increasingly clear that no matter what party is in power, so long as our national security needs keep rising, an economy hampered by restrictive tax rates will never produce enough revenues to balance our budget, just as it will never produce enough jobs or enough profits.

I said we are going to balance an $11 billion budget deficit in a $29 billion budget, so by percentage, the largest budget deficit in America, by percentage, larger than California, larger than New York, larger than Illinois. And we're going to balance that without raising taxes on the people of the state of New Jersey.

When you raise the budget, you make creative compromises. The higher the budget goes, the more cuts in your movie happen. When people talk about how movies are watered down, that's a direct reflection of money and budget. The less money you spend; the more risks you can take. That doesn't mean it will be successful, but at least you can try different stuff. The higher your budget is, the less you can do that.

I'm pleased that I've balanced budgets. I was on the world of business for 25 years. If you didn't balance your budget, you went out of business. I went into the Olympics that was out of balance, and we got it on balance, and made a success there. I had the chance to be governor of a state. Four years in a row, Democrats and Republicans came together to balance the budget. We cut taxes 19 times and balanced our budget.

So when folks talk about the deficit and leaving the deficit for our children, we will never get out of debt had this country until people get back to work, until they have good-paying jobs, and in between times, we will not move this economy forward until we are helping people be able to keep going in this recession.