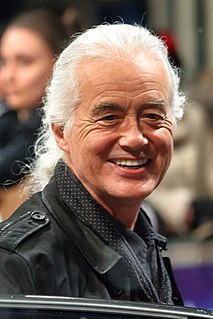

A Quote by George Soros

Markets are constantly in a state of uncertainty and flux and money is made by discounting the obvious and betting on the unexpected.

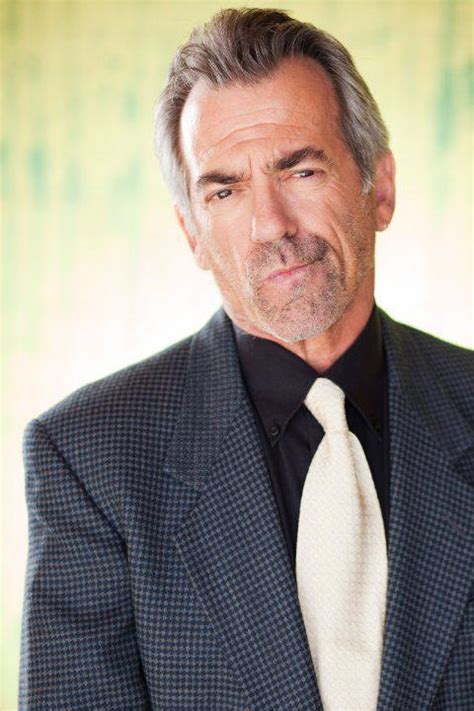

Quote Topics

Related Quotes

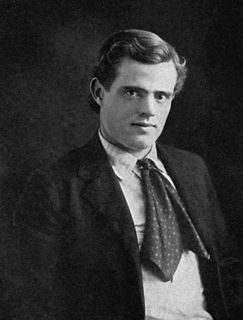

It is a simple matter to see the obvious, to do the expected. The tendency of the individual life is to be static rather than dynamic, and this tendency is made into a propulsion by civilization, where the obvious only is seen, and the unexpected rarely happens. When the unexpected does happen, however, and when it is of sufficiently grave import, the unfit perish. They do not see what is not obvious, are unable to do the unexpected, are incapable of adjusting their well-grooved lives to other and strange grooves. In short, when they come to the end of their own groove, they die.

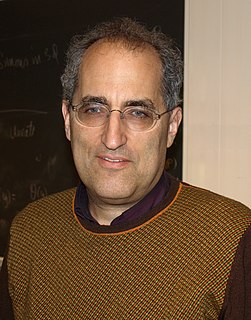

It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight! It is no trick at all to be right on the market. You always find lots of early bulls in bull markets and early bears in bear markets. I've known many men who were right at exactly the right time, and began buying or selling stocks when prices were at the very level which should show the greatest profit. And their experience invariably matched mine--that is, they made no real money out of it. Men who can both be right and sit tight are uncommon.