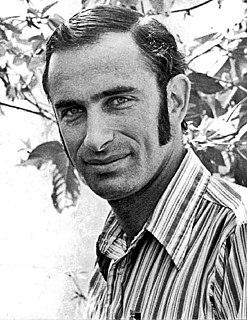

A Quote by George W. Bush

I understand gas prices are like a hidden tax - not a hidden tax; it's taking money out of people's pockets. I know that.

Related Quotes

To some, a cap-and-trade system might sound like a neat approach where the market sorts everything out. But in fact, in some ways it is worse than a tax. With a tax, the costs are obvious. With a cap-and-trade system, the costs are hidden and shifted around. For that reason, many politicians tend to like it. But that is dangerous.

Research has shown that middle-income wage earners would benefit most from a large reduction in corporate tax rates. The corporate tax is not a rich-man's tax. Corporations don't even pay it. They just pass the tax on in terms of lower wages and benefits, higher consumer prices, and less stockholder value.

The Bush administration, they had two blue ribbon commissions about infrastructure finance that recommended a lot more money, and additionally the gas tax being increased. We couldn't get them to accept being able to move forward. Since President Obama's been in office, there has been, to be charitable, a lack of enthusiasm for raising the gas tax.

You take the huge income that comes with a big gas tax, and you use it to pay off regressive taxes like the FICA [Federal Insurance Contributions Act] tax. You can help the poor in other ways besides giving them cheap gas. You want to send the message that people want to be as efficient as possible using gasoline until we can transition away from that need entirely.