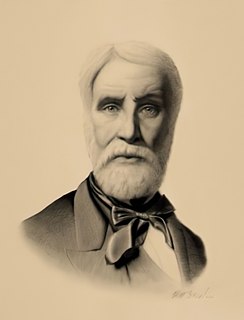

A Quote by George Will

Money is time made tangible - the time invested in the earning of it. Taxation is the confiscation of the earner's time. Although some taxation is necessary, all taxation diminishes freedom.

Related Quotes

Contrary to any claim of a systematically “neutral” effect of taxation on production, the consequence of any such shortening of roundabout methods of production is a lower output produced. The price that invariably must be paid for taxation, and for every increase in taxation, is a coercively lowered productivity that in turn reduces the standard of living in terms of valuable assets provided for future consumption. Every act of taxation necessarily exerts a push away from more highly capitalized, more productive production processes in the direction of a hand-to-mouth-existence.

The only beneficiaries of income taxation are the politicians, for it not only gives them the means by which they can increase their emoluments, but it also enables them to improve their importance. The have-nots who support the politicians in the demand for income taxation do so only because they hate the haves; . . . the sum of all the arguments for income taxation comes to political ambition and the sin of covetousness.