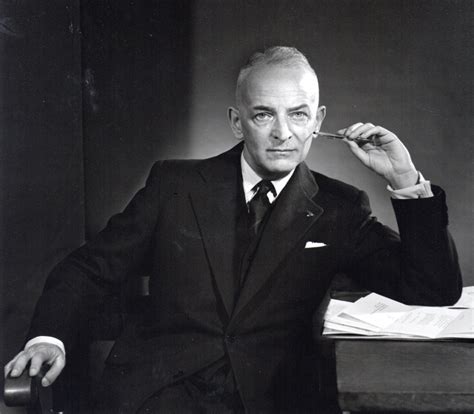

A Quote by Georges Doriot

There is always a critical job to be done. There is a sales door to be opened, a credit line to be established, a new important employee to be found, or a business technique to be learned. The venture investor must always be on call to advise, to persuade, to dissuade, to encourage, but always to help build. Then venture capital becomes true creative capital - creating growth for the company and financial success for the investing organization

Quote Topics

Advise

Always

Becomes

Build

Business

Call

Capital

Company

Creating

Creative

Credit

Critical

Done

Door

Employee

Encourage

Established

Financial

Financial Success

Found

Growth

Help

Important

Investing

Investor

Job

Learned

Line

Must

New

Opened

Organization

Persuade

Sales

Success

Technique

Then

True

Venture

Venture Capital

Related Quotes

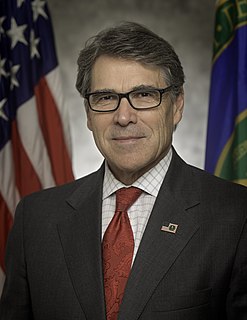

I know the difference between venture capital[ism] and vulture capitalism. Venture capitalism is a good thing, comes in, gives that gap funding to help these companies get off and get started creating jobs, and work. But Mitt Romney and Bain Capital were involved with what I call vulture capitalism. And they walked into Gaffney and took over that photo album company for no other reason than to basically pick the bones clean. And those people lost their jobs.

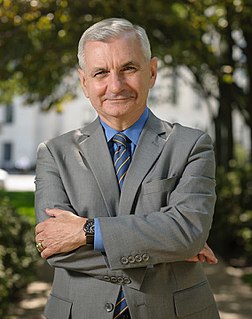

I was encouraged to break all the rules but to take the best of philanthropy, the best of investing, and the best of development finance, and experiment with new ways to create this venture capital model of using philanthropy to back patient capital investments, and then build solutions that were measured in terms of the kind of impact and change they were making on people's lives and in the world, not just on the financial return.

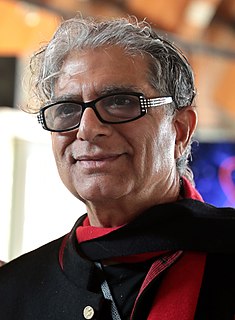

Working in the context of ultra-famous brands like Dior and Vuitton, creative spirits are always going to feel reined in. It's important that they are free to develop ideas. And rather than detracting from the principal job, it reinforces it. I think of that money as venture capital. It's not a big investment.

The financial doctrines so zealously followed by American companies might help optimize capital when it is scarce. But capital is abundant. If we are to see our economy really grow, we need to encourage migratory capital to become productive capital - capital invested for the long-term in empowering innovations.