A Quote by Gerry Harvey

If a company in Australia has to pay tax and the other one doesn't, of course it's a disadvantage.

Related Quotes

The worst loophole is what Donald Trump has talked about: the tax deductibility of interest. If you let real estate owners or corporate raiders borrow the money to buy a property or company, and then pay interest to the bondholders, you'll load the company you take over with debt. But you don't have to pay taxes on the profits that you pay out in this way. You can deduct the interest from your tax liability.

Millions and millions of people don't pay an income tax, because they don't earn enough to pay on one, but you pay a land tax whether it ever did or ever will earn you a penny. You should pay on things that you buy outside of bare necessities. I think this sales tax is the best tax we have had in years.

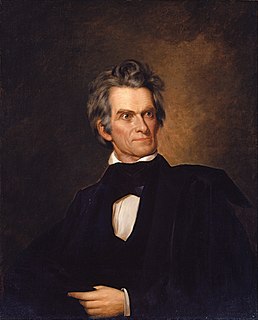

[The taxing power of the state] divides the community into two great classes: one consisting of those who, in reality, pay the taxes and, of course, bear exclusively the burden of supporting the government; and the other, of those who are the recipients of their proceeds through disbursements,and who are, in fact, supported by the government; or, in fewer words, to divide it into tax-payers and tax-consumers. But the effect of this is to place them in antagonistic relations in reference to the fiscal action of the government and the entire course of policy therewith connected.

If I'm owed money, but I say, 'Don't pay me, pay my cousin. Don't pay me, pay my charity,' you can do that, but then the IRS requires that you pay income tax on that. It's your income if you earned it and you directed where it went. If you exercised control over where the money went, you have to pay income tax on that.

Trump himself stands to benefit dramatically from the tax cuts. One of the things they're cutting is the alternative minimum tax. Last time we have tax returns for him was in 2005, where he paid about $31 million because of the alternative minimum tax. He won't have to pay that, if this tax bill goes through. So, not only is he reordering our constitutional democracy, he is personally enriching himself - which is not new, because, of course, he's done it ever since he swore an oath to become president of the United States.

Senior executives can, after a fashion, get a portion of their pay tax-free. You defer part of your income and not have to pay taxes on it, and then when you retire you have the company buy a life insurance policy on you using that money. The company can deduct that money because it is a business expense, and the money will get paid out to your children or grandchildren when you die, so you have effectively given them your money and it's never been taxed.

I hope people understand that when you tax corporations that the concrete and the steel and the plastic don't pay. People pay. And so when you tax corporations, either the employees are going to pay or the shareholders are going to pay or the customers are going to pay. And so corporations are people.

I think we should have basically the same tax policy that Germany, Japan, the U.K., everybody else has, which is a tax rate in the mid-20s and no loopholes. Zero. The U.S. has the most antiquated tax system. And that means some people are going to pay more taxes, and some people are going to pay less.

When you say the tax system benefits the rich, there are a lot of people who respond, "That can't be true, look at the rate of tax. The people who are rich pay a higher rate than you or I." Well, yeah, but if you don't have to pay taxes on a lot of your income, then your real tax rate is a lot lower. And if you're allowed to pay your taxes thirty years from now instead of today then you're a lot better off. People need to have a sophisticated understanding of how the system works to appreciate that the posted tax rate really has very little to do with the taxes people pay.