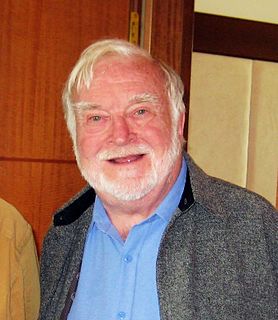

A Quote by Gerry Schwartz

I have almost no interest in quarterly reports. Running a business or investing in a business based on quarterly earnings doesn't make any sense at all to me.

Related Quotes

The filmmakers aren't running the studios anymore. Sometimes people who like films are making them, but by and large, they have to go report quarterly earnings and all that stuff. The competition is so huge that it's very hard to get people to show up to see any movie in the theater, much less an original one that isn't a version of something else they saw.

After careful consideration, we have decided that for our next fiscal year, we'll issue guidance on comparable store used unit sales and on earnings per share only for the full fiscal year. We will no longer issue quarterly guidance. This decision reflects our continuing focus on longer-term store, sales, and earnings growth and on return on invested capital, and our recognition that the performance in shorter-term periods can be more volatile than over the longer term. As we report our quarterly results, we plan to comment on how our performance is tracking against our annual guidance.

Being captive to quarterly earnings isn't consistent with long-term value creation. This pressure and the short term focus of equity markets make it difficult for a public company to invest for long-term success, and tend to force company leaders to sacrifice long-term results to protect current earnings.

Anthony and I are putting together a company where we won't lose our jobs based on quarterly earnings and can afford to play a longer game. That short game is what creates a glut of mediocrity in the market because people are desperate for hits, and it puts so much pressure on executives to deliver them. We will take that pressure off the artists.