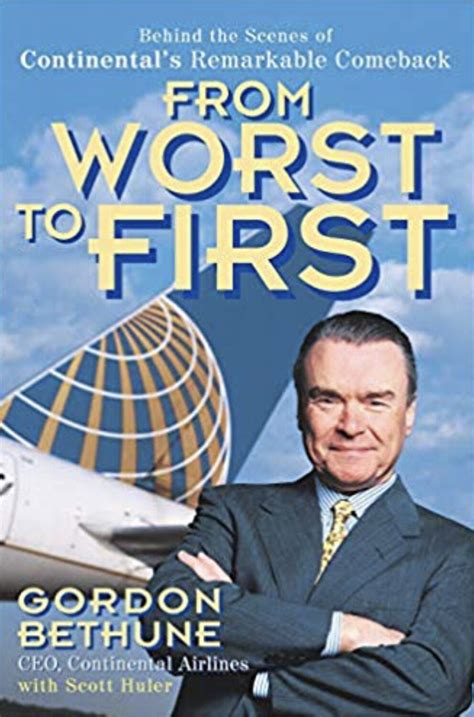

A Quote by Gordon Bethune

We tax air passengers like cigarettes and alcohol - we impose sin taxes on travellers.

Quote Topics

Related Quotes

It is easier to start taxes than to stop them. A tax an inch long can easily become a yard long. That has been the history of the income tax. Would not the sales tax be likely to have a similar history [in the U.S.]? ... Canadian newspapers report that an increase in the sales tax threatens to drive the Mackenzie King administration out of office. Canada began with a sales tax of 2%.... Starting this month the tax is 6%. The burden, in other words, has already been increased 200% ... What the U.S. needs is not new taxes, is not more taxes, but fewer and lower taxes.

Politicians like to talk about the income tax when they talk about overtaxing the rich, but the income tax is just one part of the total tax system. There are sales taxes, Medicare taxes, social security taxes, unemployment taxes, gasoline taxes, excise taxes - and when you add up all of those taxes [many of which are quite regressive], and then you look at how they affect the rich and the poor, you essentially end up with a system in which the best off 20 percent of Americans pay one percentage point more of their income than the worst off 20 percent of Americans.

All taxes, except a 'lump-sum tax,' introduce distortions in the economy. But no government can impose a lump-sum tax - the same amount for everyone regardless of their income or expenditures - because it would fall heaviest on those with less income, and it would grind the poor, who might be unable to pay it at all.

Why do we fully tax some kinds of income from capital, like interest and dividends; partially tax other kinds like capital gains; defer tax on other kinds, like IRAs; and impose no tax at all on still other types of capital income, like interest on municipal bonds? This simply is not rational. These distinctions don't have any inherent logic.

Those on the downside of rising economic inequality generally do not want government policies that look like handouts. They typically do not want the government to make the tax system more progressive, to impose punishing taxes on the rich, in order to give the money to them. Redistribution feels demeaning. It feels like being labeled a failure.

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.