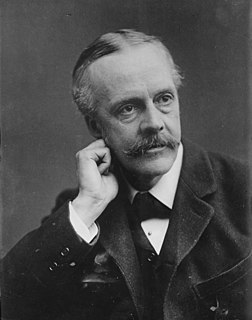

A Quote by Gordon Brown

The patriotism in Britain comes from us being a leader. On jobs, on tax havens, on workers' rights, on the environment. We can be leading Europe... and it will be to the benefit of every British citizen.

Related Quotes

And when the drums of war have reached a fever pitch and the blood boils with hate and the mind is closed, the leader will have no need in seizing the rights of the citizenry. Rather, the citizenry infused with fear and blinded by patriotism, will offer up all of their rights unto the leader and do it gladly so.

I have a plan. It entails leading to a fair deal and relationship with the British. We will be reasonable, but we will also negotiate firmly and without gullibility. I believe we must come to an agreement for the people of Britain and the people on the Continent, but not under exclusively British terms.

I want to end tax dumping. States that have a common currency should not be engaged in tax competition. We need a minimum tax rate and a European finance minister, who would be responsible for closing the tax loopholes and getting rid of the tax havens inside and outside the EU. It is also clear that we have to reach common standards in our economic and labor policies. We cannot continue to just talk about technical details. We have to inspire enthusiasm in Germany for Europe.

Basic US economics tells us that back-of-the-house workers are very unlikely to get more pay overall. The fact that workers are in those jobs means employers are already paying them what they need to pay them to get them in the current environment. If employers do share some tips with them, it will likely be offset by a reduction in their base pay.