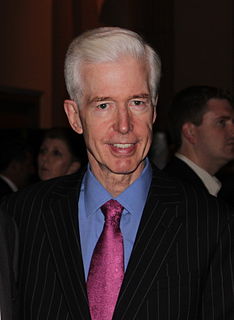

A Quote by Gray Davis

There's no question that California, in the last three or four years, has been privileged to add disproportionately to the economic growth of America, and to contribute to its technological productivity.

Related Quotes

During the last two centuries, there have been many deflations throughout the world. Almost all of them have been good ones precipitated by technological innovation, rising productivity, global capital flows, and sustained economic growth. If farm mechanization cuts the price of wheat, you get a rising living standard. This is good.

Some people think it's a law that when productivity goes up, everybody benefits. There is no economic law that says technological progress has to benefit everybody or even most people. It's possible that productivity can go up and the economic pie gets bigger, but the majority of people don't share in that gain.

Health care is in as bad a shape as it has ever been after eight years of Barack Obama and the Democrat Party running it and running the US economy. It's an absolute disaster. Other areas of the economy are a disaster. Economic growth? There isn't any. It's 1% per quarter, a 4% growth rate per year if we're lucky. There is no expansion. There is no productivity increase.

Let's take Southeast Asia. The last 20, 30 years has been what's called the "Asian Miracle" - fast economic growth, industrial society. It's happening all over, with one exception, which one? The Philippines is the one that can't grow, which the US has been running for 100 years. Is there a correlation? Have you read about it? It comes to mind, at least.