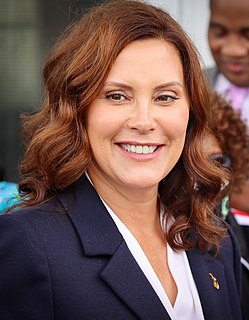

A Quote by Gretchen Whitmer

Related Quotes

Here's the truth. The proposed top rate of income tax is not 50 per cent. It is 50 per cent plus 1.5 per cent national insurance paid by employees plus 13.3 per cent paid by employers. That's not 50 per cent. Two years from now, Britain will have the highest tax rate on earned income of any developed country.

I would favor three policies: raising the minimum wage to $12, closing the tax loophole where persons only pay a 15% income tax on long term capital gains (tax it at the full tax rate), and institute a progressive tax moving the highest tax rate from 39.6% to 45%. I would favor implementing these three policies in that order, starting with raising the minimum wage, but not stopping there.

The Bush administration, they had two blue ribbon commissions about infrastructure finance that recommended a lot more money, and additionally the gas tax being increased. We couldn't get them to accept being able to move forward. Since President Obama's been in office, there has been, to be charitable, a lack of enthusiasm for raising the gas tax.

You take the huge income that comes with a big gas tax, and you use it to pay off regressive taxes like the FICA [Federal Insurance Contributions Act] tax. You can help the poor in other ways besides giving them cheap gas. You want to send the message that people want to be as efficient as possible using gasoline until we can transition away from that need entirely.

When two working people decide to marry, their federal income tax is usually increased. As soon as one spouse earns at least 20 percent of a married couple's total income, the couple pays a 'marriage tax.' ... The United States is the only major industrialized nation in the free world in which the tax cost of the second [married] earner's entry into the work force is higher than that of the first. On one hand, our government's social policy is to help working women earn equal salaries to those of men, but on the other we have a tax structure that penalizes them when they do so.

We've been prepared to make the arguments for lowering corporation tax, which is all about encouraging risk takers, encouraging entrepreneurs, and I observe that for the vast majority of the Labour government we had a top rate of 40 per cent income tax. It's now higher, and I think we should look to get to a simpler, lower tax system.

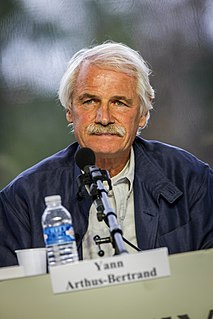

The fact is that seven per cent of the global population emits 50 per cent of greenhouse gas emissions, and the proportions are the same for the use of energy and raw materials, meat, wood, etc. Simply put, an infinitesimal minority consumes the most and imposes damage on the overwhelming majority, while asking it to change.

If we choose to keep those tax breaks for millionaires and billionaires, if we choose to keep a tax break for corporate jet owners, if we choose to keep tax breaks for oil and gas companies that are making hundreds of billions of dollars, then that means we've got to cut some kids off from getting a college scholarship.