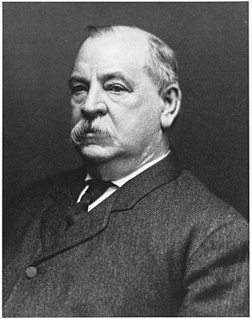

A Quote by Grover Cleveland

No investment on earth is so safe, so sure, so certain to enrich its owners as undeveloped realty. I always advise my friends to place their savings in realty near a growing city. There is no such savings bank anywhere.

Related Quotes

If you wanted to create jobs in a way that has minimal effect on the deficit but has government action, the two best things you could do are the infrastructure bank and a simple SBA-like loan guarantee for all building retrofits, where the contractor or the energy-service company guarantees the savings. So that allows the bank to loan money to let a school or a college or a hospital or a museum or a commercial building unencumbered by debt to loan it on terms that are longer, so you can pay it back only from your utility savings. You could create a million jobs doing that.

Social Security is an insurance policy. It's a terrible investment vehicle. Social Security has some great benefits. But it was never meant to be a savings plan. So we need to have a national debate. Should this 12.5 percent that we're contributing all go into a Social Security pool, or should half go into a mandatory savings plan?