A Quote by Guy Standing

Nobody should be allowed to fund political parties unless they pay at least 30% tax on all income above the median wage. If that rule applied, the Tory party would be bankrupted overnight.

Related Quotes

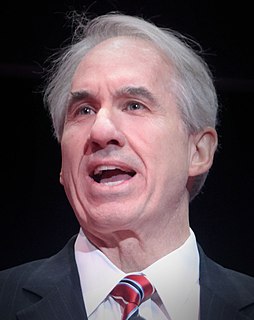

I would favor three policies: raising the minimum wage to $12, closing the tax loophole where persons only pay a 15% income tax on long term capital gains (tax it at the full tax rate), and institute a progressive tax moving the highest tax rate from 39.6% to 45%. I would favor implementing these three policies in that order, starting with raising the minimum wage, but not stopping there.

If you're a wealthy heir with a trust fund, and you sell stocks, make your 10% gains since Donald Trump, and then you buy other stocks, you can avoid paying taxes. And if your accountant registers your wealth offshore in a Panamanian fund, like Russian kleptocrats do - and as more and more Americans do - you don't have to pay any tax at all, because it's not American income, it's foreign income in an enclave without an income tax.

Research has shown that middle-income wage earners would benefit most from a large reduction in corporate tax rates. The corporate tax is not a rich-man's tax. Corporations don't even pay it. They just pass the tax on in terms of lower wages and benefits, higher consumer prices, and less stockholder value.

If I'm owed money, but I say, 'Don't pay me, pay my cousin. Don't pay me, pay my charity,' you can do that, but then the IRS requires that you pay income tax on that. It's your income if you earned it and you directed where it went. If you exercised control over where the money went, you have to pay income tax on that.

When the Constitution was written in 1787, there was this supposition that American politics would be above party. The people who would staff the positions in government would have the interests of the country, or at least their states and congressional districts, at heart, and so they wouldn't form permanent political parties.

Millions and millions of people don't pay an income tax, because they don't earn enough to pay on one, but you pay a land tax whether it ever did or ever will earn you a penny. You should pay on things that you buy outside of bare necessities. I think this sales tax is the best tax we have had in years.

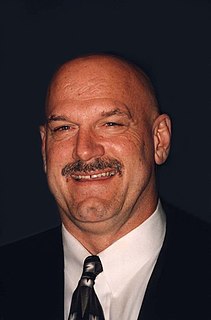

There's a separation of church and state. If you want the perks that churches have traditionally received, then abide by the rules. If you're going to be involved in the political process, even in soft ways, then surrender the privileges. Let ministers pay income tax on all of their income. Let churches pay income tax, let them pay property taxes. They can't have it both ways. You can't pat the politicians on the back, break the rules, and then get all these perks.

You, as a wage earner have to pay your taxes every year on your income for that year. So if you have a one-time windfall that makes you a lot money you could end up in the top tax bracket. But if you're a corporation you are allowed to reach forward with deferrals for years. Over a 45 to 50 year period, you can balance out the winning years and the losing years in such a way that you pay very little tax, especially considering the time-value of the money.

It's one thing to maintain that upper-income earners should pay higher tax rates because they are better able to shoulder the burden for essential government services. But it's constitutional blasphemy to claim that the tax code should be used as a weapon against the wealthy and that the state should be the tyrannical arbiter of how income is distributed.

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.