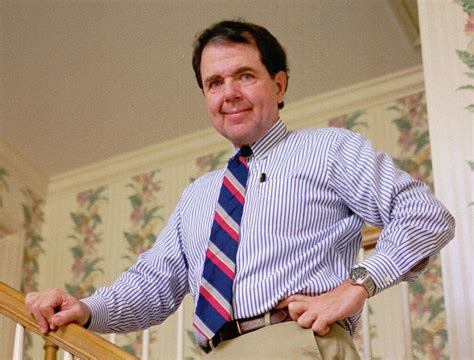

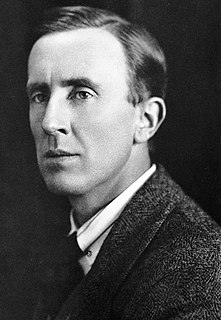

A Quote by H. L. Mencken

Wealth - any income that is at least one hundred dollars more a year than the income of one's wife's sister's husband.

Related Quotes

If you're a wealthy heir with a trust fund, and you sell stocks, make your 10% gains since Donald Trump, and then you buy other stocks, you can avoid paying taxes. And if your accountant registers your wealth offshore in a Panamanian fund, like Russian kleptocrats do - and as more and more Americans do - you don't have to pay any tax at all, because it's not American income, it's foreign income in an enclave without an income tax.

The standard of 'affordable' housing is that which costs roughly 30 percent or less of a family's income. Because of rising housing costs and stagnant wages, slightly more than half of all poor renting families in the country spend more than 50 percent of their income on housing costs, and at least one in four spends more than 70 percent.