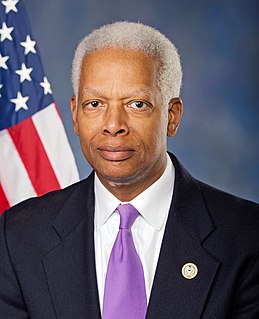

A Quote by Hank Johnson

The rising costs of higher education coupled with the stress of paying student loans are putting increasing pressure on students.

Related Quotes

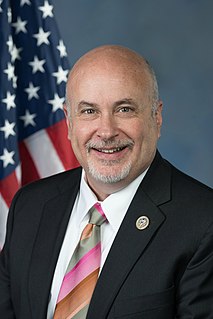

The higher amount you put into higher education, at the federal level particularly, the more the price of higher education rises. It's the dog that never catches its tail. You increase student loans, you increase grants, you increase Pell grants, Stafford loans, and what happens? They raise the price.

Student loans have been helpful to many. But they offer neither incentive nor assistance to those students who, by reason of family or other obligations, are unable or unwilling to go deeper into debt. ... It is, moreover, only prudent economic and social policy for the public to share part of the costs of the long period of higher education for those whose development is essential to our national economic and social well-being. All of us share in the benefits - all should share in the costs.

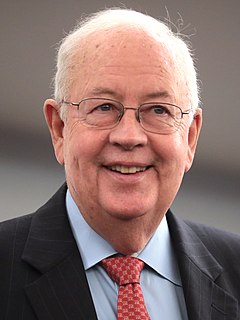

Student debt is crushing the lives of millions of Americans. How does it happen that we can get a home mortgage or purchase a car with interest rates half of that being paid for student loans? We must make higher education affordable for all. We must substantially lower interest rates on student loans. This must be a national priority.