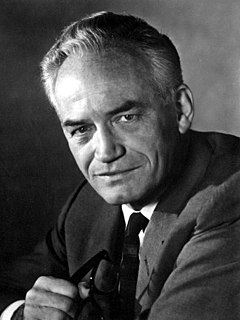

A Quote by Harold Ford, Jr.

You've got to either say you're going to cut taxes and find some spending cuts. I think we ought to reform long-term entitlement spending in the country, but you can't out of one side of your mouth say, 'Yes, we're for tax cuts, we're for spending discipline, and we're for bringing down the debt.'

Related Quotes

If the US Government was a family—they would be making $58,000 a year, spending $75,000 a year, & are $327,000 in credit card debt. They are currently proposing BIG spending cuts to reduce their spending to $72,000 a year. These are the actual proportions of the federal budget & debt, reduced to a level that we can understand.

Any politician that says no tax revenue or zero spending cuts does not deserve reelection. Our hole is so deep in this country with the debt and the debt service, the interest on that debt, before the big expenses come for Social Security and Medicare - for we baby boomers in a few years - that everything has to be on the table.

If you ask the question of Americans, should we pay our bills? One hundred percent would say yes. There's a significant misunderstanding on the debt ceiling. People think it's authorizing new spending. The debt ceiling doesn't authorize new spending; it allows us to pay obligations already incurred.

What does it mean when Republicans and Democrats alike warn us about the 'pain' involved in cutting government spending - in their spending less of our money? For the average citizen, what pain is there in his keeping more of his money to invest it the way he wants? Taxes cost people. Tax cuts do not cost government.