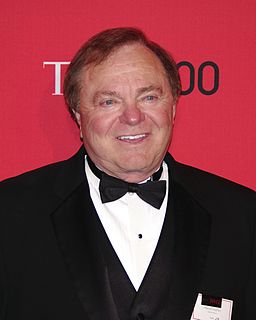

A Quote by Harold Hamm

A commodity producer should be comfortable being exposed to prices.

Related Quotes

There is no such thing as agflation. Rising commodity prices, or increases in any prices, do not cause inflation. Inflation is what causes prices to rise. Of course, in market economies, prices for individual goods and services rise and fall based on changes in supply and demand, but it is only through inflation that prices rise in aggregate.

The banker, therefore, is not so much primarily a middleman in the commodity "purchasing power" as a producer of this commodity. However, since all reserve funds and savings today usually flow to him, and the total demand for free purchasing power, whether existing or to be created, concentrates on him, he has either replaced private capitalists or become their agent; he has himself become the capitalist par excellence.