A Quote by Harold MacMillan

Related Quotes

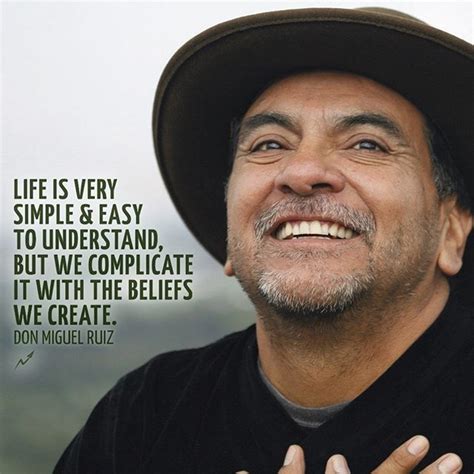

Being a good steward of your pain. . . . It involves being alive to your life. It involves taking the risk of being open, of reaching out, of keeping in touch with the pain as well as the joy of what happens because at no time more than at a painful time do we live out of the depths of who we are instead of out of the shallows.

I felt him there with me. The real David. My David. David, you are still here. Alive. Alive in me.Alive in the galaxy.Alive in the stars.Alive in the sky.Alive in the sea.Alive in the palm trees.Alive in feathers.Alive in birds.Alive in the mountains.Alive in the coyotes.Alive in books.Alive in sound.Alive in mom.Alive in dad.Alive in Bobby.Alive in me.Alive in soil.Alive in branches.Alive in fossils.Alive in tongues.Alive in eyes.Alive in cries.Alive in bodies.Alive in past, present and future. Alive forever.

We regard using [a stock's] volatility as a measure of risk is nuts. Risk to us is 1) the risk of permanent loss of capital, or 2) the risk of inadequate return. Some great businesses have very volatile returns - for example, See's [a candy company owned by Berkshire] usually loses money in two quarters of each year - and some terrible businesses can have steady results.