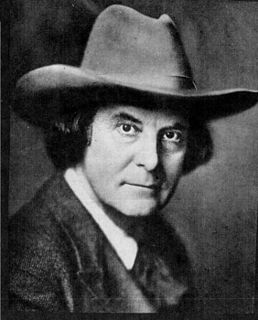

A Quote by Harold S. Geneen

In the business world, everyone is paid in two coins: cash and experience. Take the experience first; the cash will come later.

Related Quotes

There are two kinds of businesses: The first earns 12%, and you can take it out at the end of the year. The second earns 12%, but all the excess cash must be reinvested - there's never any cash. It reminds me of the guy who looks at all of his equipment and says, 'There's all of my profit.' We hate that kind of business.

We want to use cash. The reason we haven't used our cash two years ago, we just didn't find things that were that attractive. But when people talk about cash being king, it's not king if it just sits there and never does anything. There are times when cash buys more than other times, and this is one of the other times when it buys a fair amount more, so we use it.

The essence of a good investment manager is one who studies a given business and extrapolates the future cash flows that the business is likely to generate over the next several years. Based on the cash flow and asset assessment, they can then arrive at their expected rate of return if they bought a fraction of that business at a given price.

I’m not the smartest guy in the world, but I’m certainly not the dumbest. I mean, I’ve read books like "The Unbearable Lightness of Being" and "Love in the Time of Cholera", and I think I’ve understood them. They’re about girls, right? Just kidding. But I have to say my all-time favorite book is Johnny Cash’s autobiography "Cash" by Johnny Cash.