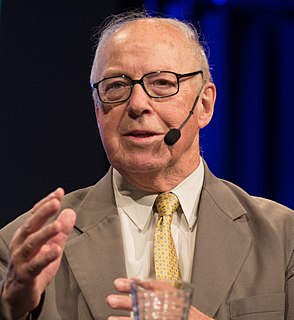

A Quote by Harry Hopkins

Related Quotes

Any Democrat who squirms on the tax-cut issue in the primaries has no chance ' zero ' to win the nomination. Each will have to take the “pledge” to oppose the Bush tax cuts. Thus, Bush will have succeeded in creating a situation where anyone who can win the nomination can't win the election. Democrats are not about to nominate anyone who backs the tax cut, and Americans are not going to elect anyone who favors a tax increase.