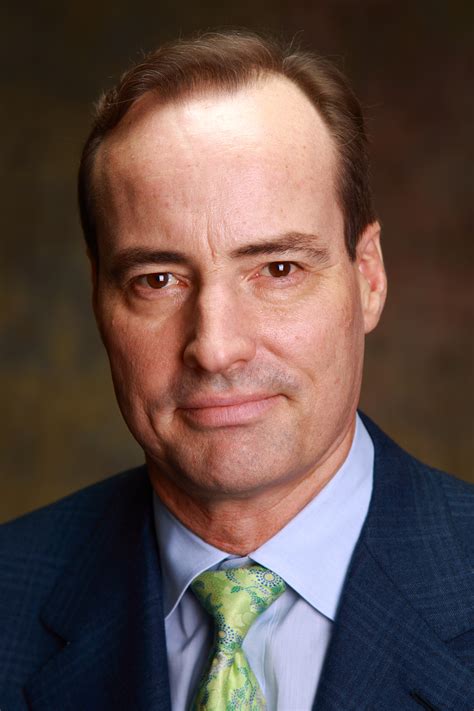

A Quote by Harry S. Dent

When markets go down, opportunities go up for smart real estate investors. I would much rather play the downturn than the upturn.

Related Quotes

Private equity capital in each of those markets Europe and Asia - while those markets have very different characteristics - fills a niche where either strategic investors or the public markets don't go, or don't want to go for some particular reason. I think that's going to continue to be the case going forward.

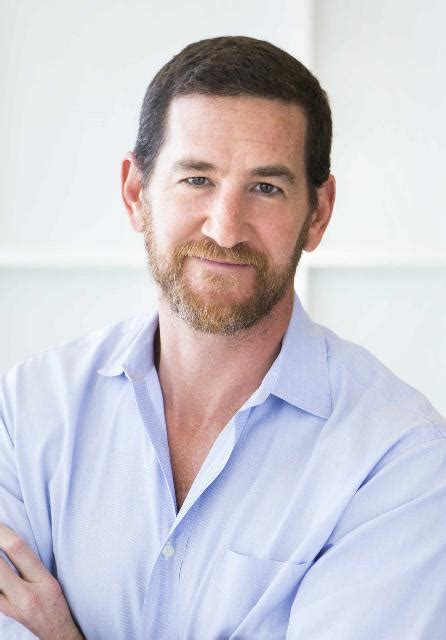

The business side of real estate investing is fraught with risk. Unlike purchasing mutual funds or savings bonds, with real estate, you can lose money; this is one of the reasons that seasoned real estate investors caution neophytes never to get too emotional about a property and always be willing to walk away.

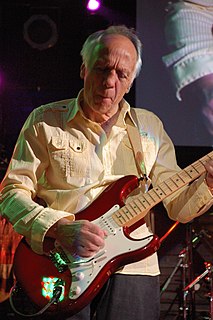

The pace of innovation may slow down or speed up depending on the appetite in the public markets, but the constant progress of technology doesn't really ever stop. There's always opportunities for new ideas and creative people to go build great things. I'm always interested in learning about those kinds of opportunities.

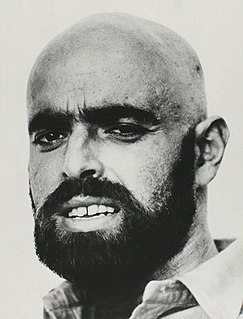

Too often, investors are the target of fraudulent schemes disguised as investment opportunities. As you know, if the balance is tipped to the point where investors are not confident that there are appropriate protections, investors will lose confidence in our markets, and capital formation will ultimately be made more difficult and expensive.