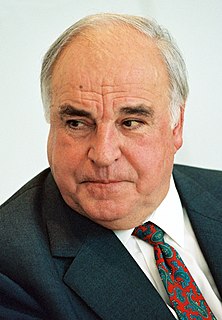

A Quote by Helmut Kohl

Two decisions have damaged the stability both of the euro and of Europe: the premature admission of Greece to the euro area and the breach and subsequent weakening of the stability and growth pact.

Related Quotes

Greeks have to know that they are not alone ... Those who are fighting for the survivor of Greece inside the Euro area are deeply harmed by the impression floating around in the Greek public opinion that Greece is a victim. Greece is a member of the EU and the euro. I want Greece to be a constructive member of the Union because the EU is also benefiting from Greece.

I don't want euro bonds that serve to mutualize the entire debt of the countries in the euro zone. That can only work in the longer-term. I want euro bonds to be used to finance targeted investments in future-oriented growth projects. It isn't the same thing. Let's call them 'project bonds' instead of euro bonds.

China has really succeeded because of its stability.

So my feeling is, how they are going to maintain this fantastic stability in a very fast changing economic situation.

I think this is a challenge we face, how the global region will evolve in stability with such a fast growth.

If they succeed to do that, no doubt, in the next generation it will be the major area of the world, economically.

Businesses will only invest in Greece if three conditions are fulfilled. First, there must be a clear commitment to the euro. No businesses will invest if they have to fear that Greece will leave the euro zone at some point. Second, the Greek government must be prepared to work together with European institutions in order to restructure the country.