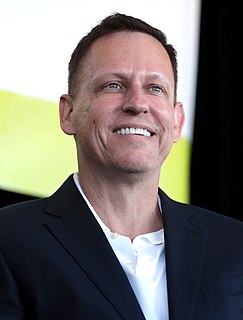

A Quote by Henrik Fisker

Once investors come in, it's hardly your company anymore!

Related Quotes

It's really hard to break through the clutter and get the attention of the top investors, as they typically only look at deals that come in from a warm, credible referral. There's absolutely nothing more credible than getting an endorsement from a well-known subject matter expert who has already put their own money into your company.