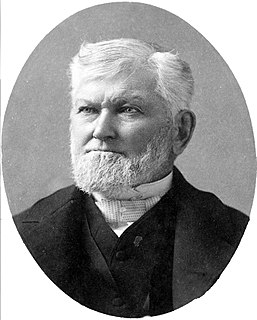

A Quote by Henry David Thoreau

Even the poor student studies and is taught only political economy, while that economy of living which is synonymous with philosophy is not even sincerely professed in our colleges. The consequence is, that while he is reading Adam Smith, Ricardo, and Say, he runs his father in debt irretrievably.

Related Quotes

If you have a sane economy, and by sane economy I mean one which is not addicted to debt, not a Ponzi economy, then the change in debt each year should contribute a minor amount to demand. Therefore, if you tried to correlate debt to the level of unemployment you would not find much of a correlation. Unfortunately that is not the economy we live in.

Only by transforming our own economy to one of peace can we make possible economic democracy in the Third World or our own country. The present economy generates wars to protect its profits and its short-term interests, while squandering the future. Unless we transform the economy, we cannot end war.

There are all sorts of institutions in the economic world which depart from the simple price/market model which I worked on in an earlier incarnation and which has been sort of the mainstream of economic theories since Adam Smith and David Ricardo. There are all sorts of contractual relations between firms and individuals which do not conform to the simple price theory - profit-sharing schemes and so forth - and the explanation for these suddenly became clear. We now understand why these emerged and that they are based on differences in information in the economy.

Canadians no longer have any financial room. Half of Canadians are $200 away from insolvency. They are facing a slowing economy with a diminishing number of jobs, and a rising cost of living to go along with it. That is the consequence of the Trudeau, Morneau tax-and-spend agenda, which is driving our economy down.

Italy is the fourth-largest economy in Europe and the eighth-largest economy in the world, and its banking system is collapsing. And Germany is desperate. It must maintain its standard of living. It can only do that with exports and Deutsche Bank is very exposed to Italian debt. But so is the rest of Europe.

We feel led to caution . . . against forming the bad habit of incurring debt and taking upon themselves obligations which frequently burden them heavier than they can bear, and lead to the loss of their homes and other possessions. We know it is the fashion of the age to use credit to the utmost limit. . . . We, therefore, repeat our counsel . . . to shun debt. Be content with moderate gains, and be not misled by illusory hopes of acquiring wealth. . . . Let our children also be taught habits of economy, and not to indulge in tastes which they cannot gratify without running into debt.

The bottom line for housing is that the concerns we used to hear about the possibility of a devastating collapse—one that might be big enough to cause a recession in the U.S. economy—while not fully allayed have diminished. Moreover, while the future for housing activity remains uncertain, I think there is a reasonable chance that housing is in the process of stabilizing, which would mean that it would put a considerably smaller drag on the economy going forward.