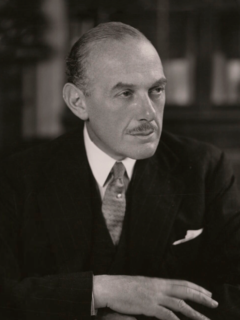

A Quote by Henry Ford

The two most important things in any company do not appear in its balance sheet: its reputation and its people.

Related Quotes

Meetings are the linchpin of everything. If someone says you have an hour to investigate a company, I wouldn't look at the balance sheet. I'd watch their executive team in a meeting for an hour. If they are clear and focused and have the board on the edge of their seats, I'd say this is a good company worth investing in.

To minimize market uncertainty and achieve the maximum effect of its policies, the Federal Reserve is committed to providing the public as much information as possible about the uses of its balance sheet, plans regarding future uses of its balance sheet, and the criteria on which the relevant decisions are based.