A Quote by Henry George

Related Quotes

Economists are almost unanimous in conceding that the land tax has no adverse side effects. ...Landowners ought to look at both sides of the coin. Applying a tax to land values also means removing other taxes. This would so improve the efficiency of a city that land values would go up more than the increase in taxes on land.

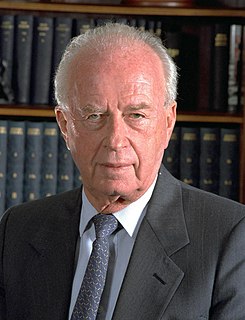

Here, in the Land of Israel, we returned and built a nation. Here, in the Land of Israel, we established a State. The Land of the prophets, which bequeathed to the world the values of morality, law and justice, was after two thousand years, restored to its lawful owner - the members of the Jewish People, On its Land, we have built an exceptional national Home and State.

The tax upon land values is the most just and equal of all taxes. It falls only upon those who receive from society a peculiar and valuable benefit, and upon them in proportion to the benefit they receive.It is the taking by the community for the use of the community of that value which is the creation of the community. It is the application of the common property to common uses. When all rent is taken by taxation for the needs of the community, then will the equality ordained by nature be attained.

First thing the developer has to do is to get an assessment of the threatened species, of the ecological values of that site. At the moment, that developer lodges an application, there's usually trade-offs, negotiations, you end up with remnant bits of land. You might end up with some other offset land that the public has to run. There's no cohesive system of then making sure that we maintain and improve biodiversity values.