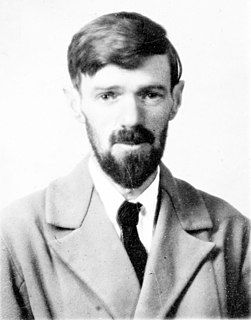

A Quote by Henry Hazlitt

Mere inflation-that is, the mere issuance of more money, with the consequence of higher wages and prices-may look like the creation of more demand. But in terms of the actual production and exchange of real things it is not.

Related Quotes

There is no such thing as agflation. Rising commodity prices, or increases in any prices, do not cause inflation. Inflation is what causes prices to rise. Of course, in market economies, prices for individual goods and services rise and fall based on changes in supply and demand, but it is only through inflation that prices rise in aggregate.

Requiring the payment of higher wages will lead to a loss of some jobs and a raising of prices which drives companies to search for automation to reduce costs. On the other hand, those receiving higher wages will spend more (the marginal propensity to consume is close to 1 for low income earners) and this will increase demand for additional goods and services. Henry Ford had the clearest vision of why companies can actually benefit by paying higher wages.

Must love be ever treated with profaneness as a mere illusion? or with coarseness as a mere impulse? or with fear as a mere disease? or with shame as a mere weakness? or with levity as a mere accident? whereas it is a great mystery and a great necessity, lying at the foundation of human existence, morality, and happiness,--mysterious, universal, inevitable as death.

The effect of metals speculation was to push up the prices that China had to pay to countries like Australia. This squeezed China. Once the speculative demand ended, all of a sudden the added production facilities that had been brought into production by the high prices went out of production again, and there was a glut.

This morning, prompted by increasing concerns about terrorism, oil prices reached a record high as the cost of a barrel of crude is a whopping $44.34. Wow, it seems shocking that a product of finite supply gets more expensive the more we use it. Now the terror alert means higher oil prices, which oddly enough means higher profits for oil companies giving them more money to give to politicians whose policies may favor the oil companies such as raising the terror alert level. As Simba once told us: "It's the circle of life."

The more we try to live in the world of words, the more we feel isolated and alone, the more all the joy and liveliness of things is exchanged for mere certainty and security. On the other hand, the more we are forced to admit that we actually live in the real world, the more we feel ignorant, uncertain, and insecure about everything.

The idea that when people see prices falling they will stop buying those cheaper goods or cheaper food does not make much sense. And aiming for 2 percent inflation every year means that after a decade prices are more than 25 percent higher and the price level doubles every generation. That is not price stability, yet they call it price stability. I just do not understand central banks wanting a little inflation.