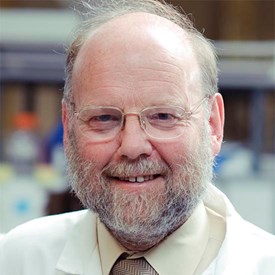

A Quote by Henry Kaufman

I do sense that the financial system is under the gun. In order to keep our system and economies moving globally, there's the need to extend new money.

Related Quotes

Growing economies are critical; we will never be able to end poverty unless economies are growing. We also need to find ways of growing economies so that the growth creates good jobs, especially for young people, especially for women, especially for the poorest who have been excluded from the economic system.