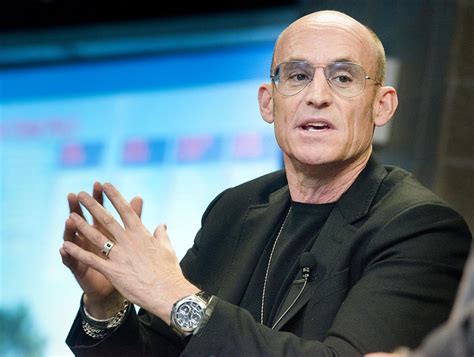

A Quote by Henry Kravis

To understand KKR, I always like to say, don't congratulate us when we buy a company. Any fool can buy a company. Congratulate us when we sell it and when we've done something with it and created real value.

Related Quotes

Thousands of salespeople are pounding the pavements today, tired, discouraged and underpaid. Why? Because they are always thinking only of what they want. They don't realize that neither you nor I want to buy anything. If we did, we would go out and buy it. But both of us are eternally interested in solving our problems. And if salespeople can show us how their services or merchandise will help us solve our problems, they won't need to sell us. We'll buy. And customers like to feel that they are buying - not being sold.

When you buy enough stocks to give you control of a target company, that's called mergers and acquisitions or corporate raiding. Hedge funds have been doing this, as well as corporate financial managers. With borrowed money you can take over or raid a foreign company too. So, you're having a monopolistic consolidation process that's pushed up the market, because in order to buy a company or arrange a merger, you have to offer more than the going stock-market price. You have to convince existing holders of a stock to sell out to you by paying them more than they'd otherwise get.

Lord, please restore to us the comfort of merit and demerit. Show us that there is at least something we can do. Tell us that at the end of the day there will at least be one redeeming card of our very own. Lord, if it is not too much to ask, send us to bed with a few shreds of self-respect upon which we can congratulate ourselves. But whatever you do, do not preach grace. Give us something to do, anything; but spare us the indignity of this indiscriminate acceptance.