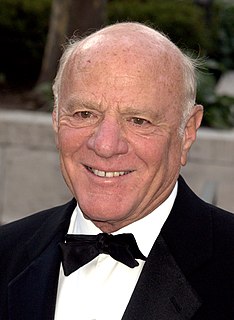

A Quote by Herman Cain

I think that taxes would be fair if we first get rid of the tax code.

Related Quotes

I think that taxes would be fair if we first get rid of the tax code. This is the ultimate solution, not to just say we're going to trim around the edges, not to say that we will try to simplify a little of this and a little of that. The problem is, replace the tax code, so we can establish tax fairness for everybody.

Now, the president would like to do tax reform, which would obviously lower rates for most people in America and make the tax code fair and get rid of loopholes and special treatment. But absent tax reform, the president believes the right way to get our fiscal house in order is ask the wealthy to pay their fair share.

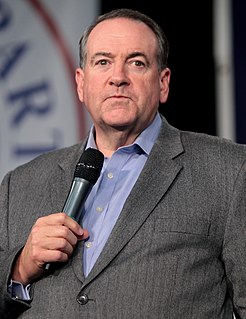

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.

We need to lower tax rates for everybody, starting with the top corporate tax rate. We need to simplify the tax code. The ultimate answer, in my opinion, is the fair tax, which is a fair tax for everybody, because as long as we still have this messed-up tax code, the politicians are going to use it to reward winners and losers.

You can use the tax code to make people smoke less. You can use the tax code to make 'em smoke more. You can use the tax code to make 'em buy beer or buy less beer, more booze or less booze. You can screw the tax code around to make 'em make more charitable contributions. You think they're going to get rid of this power? Ain't no way, fool.

Start by scrapping the tax code. Don't fiddle with it. Junk it. Throw it out. Bury it. Replace it with a pro-growth, pro-family tax cut that lowers tax rates to 17% across the board and expands exemptions for individuals and children so that a family of four would pay no taxes on the first $36,000 of income.

If I get married I get a tax break, if I have a kid I get a tax break, if I get a mortgage I get a tax break. I don't have any kids and I drive a hybrid, I think I should get a tax break. I'm trying to pay off my apartment so I have something tangible. I actually figured out if I paid off my place my reward would be that I would pay an extra four grand a year in taxes.

The 9-9-9 plan would resuscitate this economy because it replaces the outdated tax code that allows politicians to pick winners and losers, and to provide favors in the form of tax breaks, special exemptions and loopholes. It simplifies the code dramatically: 9% business flat tax, 9% personal flat tax, 9% sales tax.

It is easier to start taxes than to stop them. A tax an inch long can easily become a yard long. That has been the history of the income tax. Would not the sales tax be likely to have a similar history [in the U.S.]? ... Canadian newspapers report that an increase in the sales tax threatens to drive the Mackenzie King administration out of office. Canada began with a sales tax of 2%.... Starting this month the tax is 6%. The burden, in other words, has already been increased 200% ... What the U.S. needs is not new taxes, is not more taxes, but fewer and lower taxes.