A Quote by Hillary Clinton

I think if you had a capital-gains system where the long, patient capital would actually be rewarded, nanosecond capital turning would not be.

Related Quotes

Well, certainly the Democrats have been arguing to raise the capital gains tax on all Americans. Obama says he wants to do that. That would slow down economic growth. It's not necessarily helpful to the economy. Every time we've cut the capital gains tax, the economy has grown. Whenever we raise the capital gains tax, it's been damaged.

The financial doctrines so zealously followed by American companies might help optimize capital when it is scarce. But capital is abundant. If we are to see our economy really grow, we need to encourage migratory capital to become productive capital - capital invested for the long-term in empowering innovations.

Index funds are... tax friendly, allowing investors to defer the realization of capital gains or avoid them completely if the shares are later bequeathed. To the extent that the long-run uptrend in stock prices continues, switching from security to security involves realizing capital gains that are subject to tax. Taxes are a crucially important financial consideration because the earlier realization of capital gains will substantially reduce net returns.

If, for example, each of us had the same share of capital in the national total capital, then if the share of capital goes up it's not a problem, because you get as much as I do. The problem is that capital in capitalist countries is very heavily concentrated, especially financial capital. So then if the share of income from that source goes up, that actually exacerbates inequality.

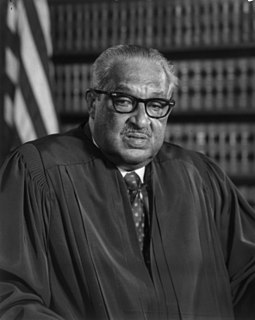

When in Gregg v. Georgia the Supreme Court gave its seal of approval to capital punishment, this endorsement was premised on the promise that capital punishment would be administered with fairness and justice. Instead, the promise has become a cruel and empty mockery. If not remedied, the scandalous state of our present system of capital punishment will cast a pall of shame over our society for years to come. We cannot let it continue.