A Quote by Hillary Clinton

What I want people to know is I went to Wall Street before the crash. I was the one saying you're going to wreck the economy because of these shenanigans with mortgages. I called to end the carried interest loophole that hedge fund managers enjoy. I proposed changes in CEO compensation.

Related Quotes

I think there are probably too many hedge fund managers in the world, as well as active fund managers. The hedge fund industry is very efficient. We see a lot of hedge funds open and a lot close. It's very binary. You either succeed or fail in the hedge fund world. If you succeed, the amount the managers make it beyond most people's wildest dreams of wealth.

When I was a Senator from New York, I represented and worked with so many talented principled people who made their living in finance. But even thought I represented them and did all I could to make sure they continued to prosper, I called for closing the carried interest loophole and addressing skyrocketing CEO pay. I also was calling in '06, '07 for doing something about the mortgage crisis, because I saw every day from Wall Street literally to main streets across New York how a well-functioning financial system is essential.

When a hedge-fund guy gets lucky because the market goes up, and he is going to make $200m, and you know $200 million, and he is going to pay almost no tax. I don't think that is a good thing for the country, and they are all supporting Jeb Bush and Hillary Clinton, all the hedge-fund guys. I don't want their support, because I'm totally self-funding my campaign.

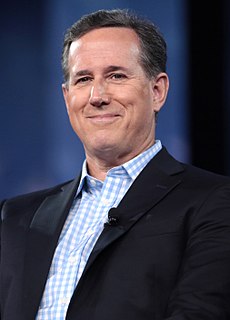

I heard governor Romney here called me an economic lightweight because I wasn't a Wall Street financier like he was. Do you really believe this country wants to elect a Wall Street financier as the president of the United States? Do you think that's the experience that we need? Someone who's going to take and look after as he did his friends on Wall Street and bail them out at the expense of Main Street America.

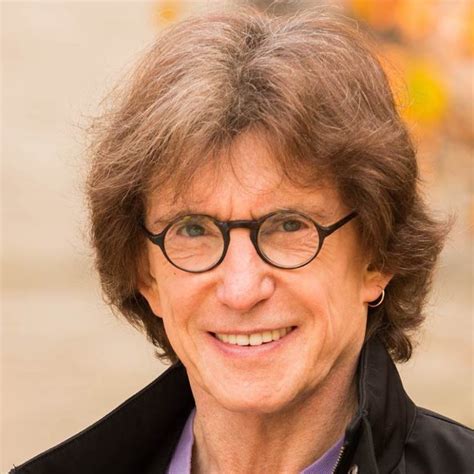

I mean, the people who got us into these crises - whether we're talking about the bankers or the hedge fund managers, or we're talking about the IMF - it's become pretty clear that the price to be paid for their illegal financial shenanigans, the burden is being placed on working class people, on the poor, on the elderly, on young people. It's become clear that neoliberal policies aren't just interested in "solving" an economic crisis, these are policies designed to enrich corporations and bankers and the rich at the expense of everybody else.

We live in a global market and money's fungible and hedge fund private equity is looking for momentum plays, and there ain't no momentum plays in bonds, right? When the interest rates were spiking up or down, well they never really spike down they do spike up though. Something's got to happen, there's got to be motion, the dice has to be rolling on the board, and if it's not then they're not going to play because they're not going to get the adrenaline rush from looking at... you know, money markets fund interest rates or bond interests or whatever. It's got to be sexy.