A Quote by Hillary Clinton

We need to have a tax system that rewards work and not just financial transactions.

Quote Topics

Related Quotes

One measure for promoting both stability and fairness across financial market segments is a small sales tax on all financial transactions - what has come to be known as a Robin Hood Tax. This tax would raise the costs of short-term speculative trading and therefore discourage speculation. At the same time, the tax will not discourage "patient" investors who intend to hold their assets for longer time periods, since, unlike the speculators, they will be trading infrequently.

The Value-Added Tax, a sales tax that applies at every level of business transactions, is an easy tax for governments to collect, and a hard tax to evade. So it makes the job of raising revenue easier. The revenues from the VAT can then be used to lower taxes on income and saving and investment. The Value-Added tax doesn't penalize work or saving; it's a tax on buying stuff.

I'd like to help struggling homeowners who can't pay their mortgages, I'd like to invest in our crumbling infrastructure, I'd like to reform the tax system so multimillionaires can't pretend their earnings are capital gains and pay at the rate of 15 percent. I'd like to make public higher education free, and pay for it with a small transfer tax on all financial transactions. I'd like to do much more - a new new deal for Americans. But Republicans are blocking me at every point.

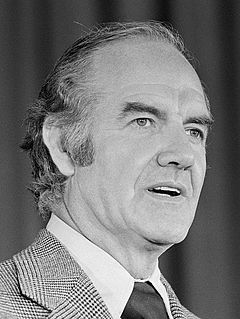

And above all, above all, honest work must be rewarded by a fair and just tax system. The tax system today does not reward hard work: it penalizes it. Inherited or invested wealth frequently multiplies itself while paying no taxes at all. But wages on the assembly line or in farming the land, these hard-earned dollars are taxed to the very last penny.

A private enterprise system needs some measuring rod, it needs something, it needs money to make its transactions. You can't run a big complicated system through barter, through converting one commodity into another. You need a monetary system to operate. And the instability in that monetary system is devastating to the performance of the economy.