A Quote by Hu Jintao

The world economy today is recovering slowly, and there are still some destabilising factors and uncertainties. The underlying impact of the international financial crisis is far from over.

Related Quotes

As I write in 2012 we certainly do not believe that it is over yet, and the worst may be yet to come. Efforts by governments to solve the underlying problems responsible for the crisis have still not gotten very far, and the 'stress tests' that governments have used to encourage optimism about our financial institutions were of questionable thoroughness.

The financial crisis and the Great Recession demonstrated, in a dramatic and unmistakable manner, how extraordinarily vulnerable are the large share of American families with very few assets to fall back on. We have come far from the worst moments of the crisis, and the economy continues to improve.

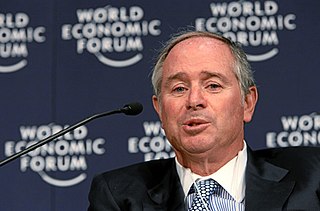

The Fed contributed to the financial crisis, keeping interest rates too low for too long. I give them credit for responding and stabilizing the economy and the financial sector during the crisis. But then they tried to do too much with quantitative easing that went on forever, just dramatically exploding their balance sheets.

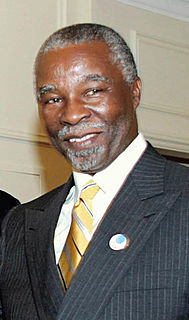

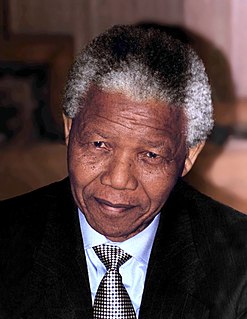

When I was in government, the South African economy was growing at 4.5% - 5%. But then came the global financial crisis of 2008/2009, and so the global economy shrunk. That hit South Africa very hard, because then the export markets shrunk, and that includes China, which has become one of the main trade partners with South Africa. Also, the slowdown in the Chinese economy affected South Africa. The result was that during that whole period, South Africa lost something like a million jobs because of external factors.

The Fed has a lot of power in the economy because it has a big impact on the supply and cost of credit, that is, interest rates. It also plays a key role in supervising banks and historically has seemed to take it easy on the banks when it shouldn't have, such as in the lead up to the financial crisis.