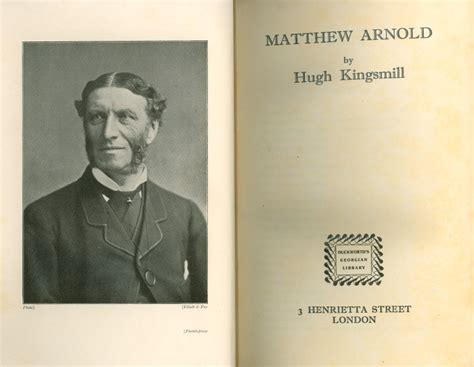

A Quote by Hugh Kingsmill

It is difficult to love mankind unless one has a reasonable private income, and when one has a reasonable private income one has better things to do than loving mankind.

Related Quotes

The final and best means of strengthening demand among consumers and business is to reduce the burden on private income and the deterrence to private initiative which are imposed by our present tax system, and this administration pledged itself last summer to an across-the-board, top-to-bottom cut in personal and corporate income taxes to be enacted and become effective in 1963.

Three-fifths to two-thirds of the federal budget consists of taking property from one American and giving it to another. Were a private person to do the same thing, we'd call it theft. When government does it, we euphemistically call it income redistribution, but that's exactly what thieves do - redistribute income. Income redistribution not only betrays the founders' vision, it's a sin in the eyes of God.

If one sentence were to sum up the mechanism driving the Great Stagnation, it is this: Recent and current innovation is more geared to private goods than to public goods. That simple observation ties together the three major macroeconomic events of our time: growing income inequality, stagnant median income, and the financial crisis.

If the Nation is living within its income, its credit is good. If, in some crises, it lives beyond its income for a year or two, it can usually borrow temporarily at reasonable rates. But if, like a spendthrift, it throws discretion to the winds, and is willing to make no sacrifice at all in spending; if it extends its taxing to the limit of the peoples power to pay and continues to pile up deficits, then it is on the road to bankruptcy.

In the '50s and in the '60s, the private insurance system originally was a benefit for the bureaucrats in Germany. And this system became ever bigger because the private insurance industry lobbied successfully for making this system bigger. In the '70s and in the '80s, they managed to find a system where they could take everyone beyond 40,000 euros income per year but didn't have to take everyone. So they only took those that had both high income and a secure job and who was not ill at that time.

I agree that income disparity is the great issue of our time. It is even broader and more difficult than the civil rights issues of the 1960s. The '99 percent' is not just a slogan. The disparity in income has left the middle class with lowered, not rising, income, and the poor unable to reach the middle class.