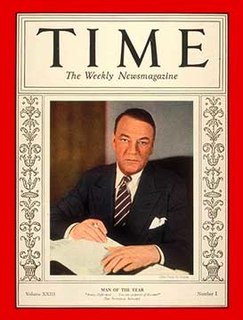

A Quote by Hugh S. Johnson

The earnings have been pretty good so far, but there's an ambiguity in the market about them, because you'll see Amazon or Microsoft disappointing and then others beating.

Related Quotes

There's always been a belief that Microsoft would respond punitively if you did something they didn't like. You were afraid of Microsoft's reaction, .. That belief has been pretty much destroyed. Vendors, clients and customers feel pretty much free do whatever they have to do in their Microsoft relationship.

Doing a me-too business, because it's you - the only person who cares about that is you. The market doesn't care if it's you. The market is pretty much being served. You better have something that the world doesn't have, because even then, you might screw it up through your own ineptitude and inexperience.

Apple isn't the next Microsoft, you see. Apple is not the next anything because the role it aspires to transcends anything imaginable by Microsoft, ever. Google is the next Microsoft, so Google is seen by Ballmer as the immediate threat - the one he has a hope in hell of actually doing something about.

Maybe it’s not, in the end, the virtues of others that so wrenches our hearts as it is the sense of almost unbearably poignant recognition when we see them at their most base, in their sorrow and gluttony and foolishness. You need the virtues, too—some sort of virtues—but we don’t care about Emma Bovary or Anna Karenina or Raskolnikov because they’re good. We care about them because they’re not admirable, because they’re us, and because great writers have forgiven them for it.