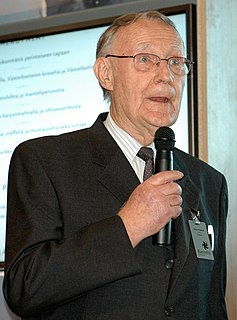

A Quote by Ingvar Kamprad

An optimised tax structure gives us the possibility of flexibility in using our assets that have already been taxed in one market. They can be used in new markets for further business development without the additional burden of double taxation.

Related Quotes

5: Social security will break small business, become a huge tax burden on our citizens, and bankrupt our country!

1944: The G.I. Bill will break small business, become a huge tax burden on our citizens, and bankrupt our country!

1965: Medicare will break small business, become a huge tax burden on our citizens, and bankrupt our country!

1994: Health care will break small business, become a huge tax burden on our citizens, and bankrupt our country!

The history of taxation shows that taxes which are inherently excessive are not paid. The high rates inevitably put pressure upon the taxpayer to withdraw his capital from productive business and invest it in tax-exempt securities or to find other lawful methods of avoiding the realization of taxable income. The result is that the sources of taxation are drying up; wealth is failing to carry its share of the tax burden; and capital is being diverted into channels which yield neither revenue to the Government nor profit to the people.

We have met our passion to be ambition to grow our market share significantly in North America. Motorola helps address two other priority markets for us - the acquisition has enabled us to become the No. 1 foreign vendor in Japan. It also gives us an increased market share with China Mobile in China.

Regarding the Economy & Taxation: America's most successful achievers do pay a higher share of the total tax burden. The top one percent income earners paid 18 percent of the total tax burden in 1981, and paid 25 percent in 1991. The bottom 50 percent of income earners paid only 8 percent of the total tax burden, and paid only 5 percent in 1991. History shows that tax cuts have always resulted in improved economic growth producing more tax revenue in the treasury.

Giving up everything must mean giving over everything to kingdom purposes, surrendering everything to further the one central cause, loosening our grip on everything. For some of us, this may mean ridding ourselves of most of our possessions. But for all of us it should mean dedicating everything we retain to further the kingdom. (For true disciples, however, it cannot mean hoarding or using kingdom assets self-indulgently.)

Though tax records are generally looked upon as a nuisance, the day may come when historians will realize that tax records tell the real story behind civilized life. How people were taxed, who was taxed, and what was taxed tell more about a society than anything else. Tax habits could be to civilization what sex habits are to personality. They are basic clues to the way a society behaves.