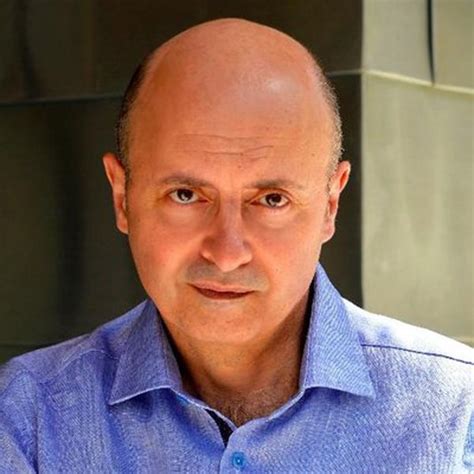

A Quote by J. B. Pritzker

You, as an entrepreneur, must make sure the postmoney valuation is a number you can obtain. You don't want too high of a valuation.

Related Quotes

Valuations are always much-debated. I try to center on what is the value to us. Is it solving a problems for us? If it is, we find a way to proceed. If the valuation has been overhyped on something and it doesn't make sense, we won't. It's very simple for me. I tend not to worry too much about the valuation. It's really what the value is to us.

The great shift... is the movement away from the value-laden languages of... the "humanities," and toward the ostensibly value-neutral languages of the "sciences." This attempt to escape from, or to deny, valuation is... especially important in psychology... and the so-called social sciences. Indeed, one could go so far as to say that the specialized languages of these disciplines serve virtually no other purpose than to conceal valuation behind an ostensibly scientific and therefore nonvaluational semantic screen.

A conventional valuation which is established as the outcome of the mass psychology of a large number of ignorant individuals is liable to change violently as the result of a sudden fluctuation of opinion due to factors which do not really make much difference to the prospective yield; since there will be no strong roots of conviction to hold it steady.