A Quote by J. D. Vance

People in my hometown voted for President Reagan - for many, like my grandpa, he was their first Republican - because he promised that tax cuts would bring higher wages and new jobs. It seemed he was right, so we voted for the next Republican promising tax cuts and job creation, George W. Bush. He wasn't right.

Related Quotes

His presidency ended more than a decade ago, but politicians, Democrat and Republican, still talk about Ronald Reagan. Al Gore has an ad noting that in Congress he opposed the Reagan budget cuts. He says that because Bill Bradley was one of 36 Democratic Senators who voted for the cuts. Gore doesn’t point out that Bradley also voted against the popular Reagan tax cuts and that it was the tax cuts that piled up those enormous deficits, a snowballing national debt.

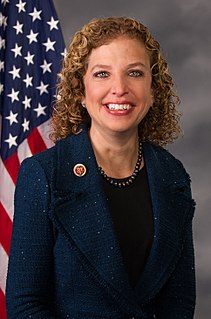

We certainly could have voted on making the middle-class tax cuts and tax cuts for working families permanent had the Republicans not insisted that the only way they would support those tax breaks is if we also added $700 billion to the deficit to give tax breaks to the wealthiest 2 percent of Americans. That's what was really disturbing.

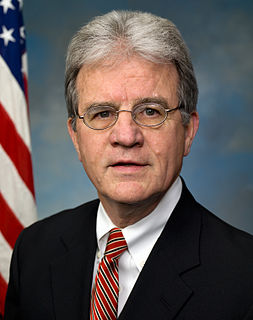

Democrats in Washington predicted that tax cuts would not create jobs, would not increase wages, and would cause the federal deficit to explode. Well, the facts are in. The tax cuts have led to a strong economy. Real wages were on the rise, and deficit has been cut in half three years ahead of schedule.

Over the past 100 years, there have been three major periods of tax-rate cuts in the U.S.: the Harding-Coolidge cuts of the mid-1920s; the Kennedy cuts of the mid-1960s; and the Reagan cuts of the early 1980s. Each of these periods of tax cuts was remarkably successful as measured by virtually any public policy metric.

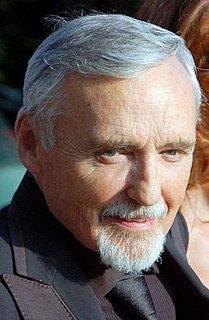

I kid the Republicans, with love. I feel bad for them. They got nobody for next time. Who are they gonna run? Sarah Palin, reading off her hand. Did you see that? You saw this? She wrote "tax cuts" on her hand. A Republican so stupid she has to be reminded of the one thing - Tax cuts! This is like if you saw the coyote's paw and it said "Road Runner".