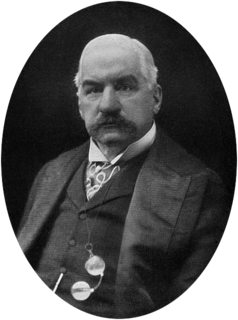

A Quote by J. P. Morgan

Giving debt relief to people that really need it, that's what foreclosure is.

Related Quotes

The Catholic community, with many others, has long worked for this new commitment on global health and debt relief (President George W. Bushs proposed $15 billion Global AIDS initiative). I hope that Congress will now appropriate the money needed to make this legislation a reality, and that the U.S. government will press for strengthening the debt relief program along the lines proposed by this legislation.

People tend to think that paying a debt is like going out and buying a car, buying more food or buying more clothes. But it really isn't. When you pay a debt to the bank, the banks use this money to lend out to somebody else or to yourself. The interest charges to carry this debt go up and up as debt grows.