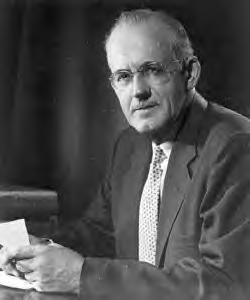

A Quote by J. Reuben Clark

Let us avoid debt as we would avoid a plague; where we are now in debt, let us get out of debt; if not today...tomorrow.

Related Quotes

Let us avoid debt as we would avoid a plague...Let every head of every household see to it that he has on hand enough food and clothing, and, where possible, fuel also, for at least a year ahead...Let every head of household aim to own his own home, free from mortgage. Let us again clothe ourselves with these proved and sterling virtues-honesty, truthfulness, chastity, sobriety, temperance, industry, and thrift; let us discard all covetousness and greed.

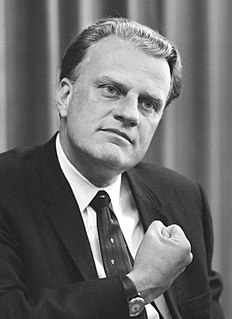

Debt is a trap, especially student debt, which is enormous, far larger than credit card debt. It's a trap for the rest of your life because the laws are designed so that you can't get out of it. If a business, say, gets in too much debt, it can declare bankruptcy, but individuals can almost never be relieved of student debt through bankruptcy.

Debt is a trap, especially student debt, which is enormous, far larger than credit card debt. It’s a trap for the rest of your life because the laws are designed so that you can’t get out of it. If a business, say, gets in too much debt it can declare bankruptcy, but individuals can almost never be relieved of student debt through bankruptcy.

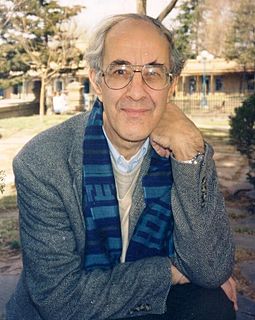

Avoid debt that doesn’t pay you. Make it a rule that you never use debt that won’t make you money. I borrowed money for a car only because I knew it could increase my income. Rich people use debt to leverage investments and grow cash flows. Poor people use debt to buy things that make rich people richer.

Shipping first time code is like going into debt. A little debt speeds development so long as it is paid back promptly with a rewrite. The danger occurs when the debt is not repaid. Every minute spent on not-quite-right code counts as interest on that debt. Entire engineering organizations can be brought to a standstill under the debt load of an unconsolidated implementation, object-oriented or otherwise.