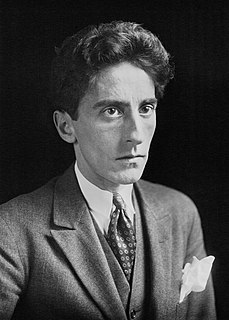

A Quote by Jack Kemp

The real problem is deflation. That is the opposite of inflation but equally serious to the borrower.

Related Quotes

With QE3, we are essentially being bought out with our own money...and unemployment is being used to facilitate this process in a very clever manner. Monetary inflation is currently being offset by labor deflation. The way you avoid collapse is by printing money and stealing assets. The way you avoid inflation is with labor deflation.

Significant changes in the growth rate of money supply, even small ones, impact the financial markets first. Then, they impact changes in the real economy, usually in six to nine months, but in a range of three to 18 months. Usually in about two years in the US, they correlate with changes in the rate of inflation or deflation."

"The leads are long and variable, though the more inflation a society has experienced, history shows, the shorter the time lead will be between a change in money supply growth and the subsequent change in inflation.

You know how it always is, every new idea, it takes a generation or two until it becomes obvious that there's no real problem. It has not yet become obvious to me that there's no real problem. I cannot define the real problem, therefore I suspect there's no real problem, but I'm not sure there's no real problem.

The Fed is pushing a variety of workarounds that would inject trillions in new money into the economy while bypassing the banking system altogether. Time will tell whether or not this will succeed. Meanwhile, a serious danger lurks around the corner. Once the recession is over, the lending will start again. With fractional-reserve banking and limitless supplies of cash on hand, we will likely see the overall price trends reversed, from deflation to inflation to possible hyperinflation.