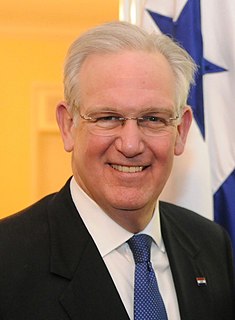

A Quote by Jack Kemp

Its no secret that I've never liked tax credits.

Related Quotes

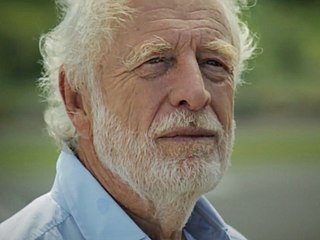

Labour ministers often look puzzled when reports show that Britain has one of the lowest levels of social mobility in the developed world. They just don't get it. They see poverty, inequality, fairness, as all about income. For the past 12 years, they have relied on tax credits to solve this. But tax credits do not solve poverty: they mask it.

Fannie and Freddie made two-thirds of all subprime mortgages. That is not a free market institution. That entity, along with the Fed printing too much money back in '03 and '04, caused the housing collapse. So we need to take free markets seriously. That means we have to put an end to all these tax credits and tax deductions and loopholes.