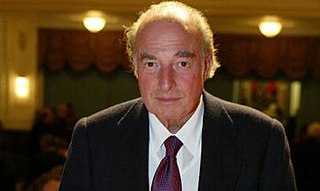

A Quote by Jacob Rees-Mogg

I was left £50 when I was ten by a fairly distant cousin, which my father invested in GEC shares on my behalf. I became interested in the market and was given some more shares by my father, which is when I began looking to see how the shares were performing and learning how to read company reports, balance sheets, and so on in order to gauge that.

Related Quotes

Christ has something in common with all creatures. With the stone he shares existence, with the plants he shares life, with the animals he shares sensation, and with the angels he shares intelligence. Thus all things are transformed in Christ since in the fullness of his nature he embraces some part of every creature.

When I received the Nobel Prize, the only big lump sum of money I have ever seen, I had to do something with it. The easiest way to drop this hot potato was to invest it, to buy shares. I knew that World War II was coming and I was afraid that if I had shares which rise in case of war, I would wish for war. So I asked my agent to buy shares which go down in the event of war. This he did. I lost my money and saved my soul.

I basically see two reasons for a going public: Glencore gets access to more money. It is a way of funding your business and to finance growth. Plus: You have more liquid shares. It is easier to leave the company and redeem your shares. The 'going public' may also be an exit strategy for the top management.

When Wal-Mart brings water down to the Katrina victims, it's not doing that to be nice; it's doing it to make larger profits and to increase the value of its shares. If its actions are not accomplishing those objectives, the shareholders can sue the executives, and sue them successfully, because it is illegal for them to act on behalf of any other reason than increasing the value of their shares. There is nothing wrong with that. That is the way that they were created and the way we want them to function to increase prosperity in the market.

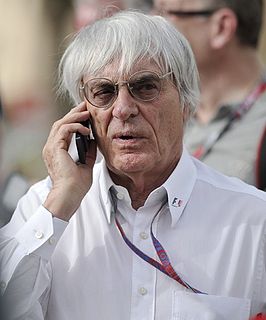

Probably when I gave things to Slavica [ Ecclestone], you know the shares of the company, and things like that. And she put it all in trust and the trust sold the shares. Um, would I turn the clock back if I could and so I still owned the company completely? Probably yes. It probably wasn't a good decision, but it was the decision that had to be made. Was I happy that I made it? No.

I would be lying if I didn't admit sadness that our wonderful airline is merging with another. Because I'm not American, the U.S. Department of Transportation stipulated I take some of my shares in Virgin America as non-voting shares, reducing my influence over any takeover. So there was sadly nothing I could do to stop it.

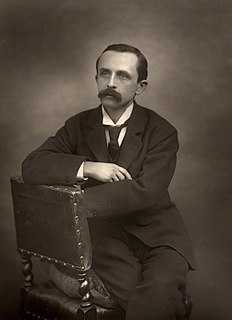

Mr. Darling used to boast to Wendy that her mother not only loved him but respected him. He was one of those deep ones who know about stocks and shares. Of course no one really knows, but he quite seemed to know, and he often said stocks were up and shares were down in a way that would have made any woman respect him.