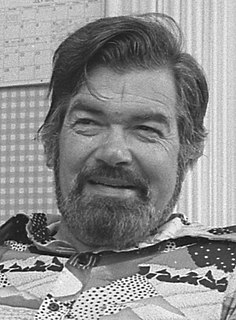

A Quote by Jacob Rees-Mogg

As a general rule, governments are wise to avoid taxation that is voluntary, as they need a steady stream of income.

Related Quotes

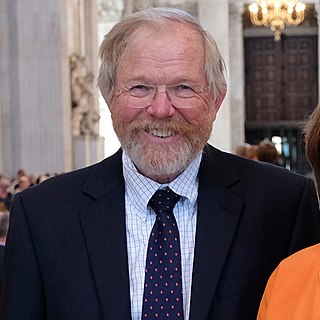

The only beneficiaries of income taxation are the politicians, for it not only gives them the means by which they can increase their emoluments, but it also enables them to improve their importance. The have-nots who support the politicians in the demand for income taxation do so only because they hate the haves; . . . the sum of all the arguments for income taxation comes to political ambition and the sin of covetousness.

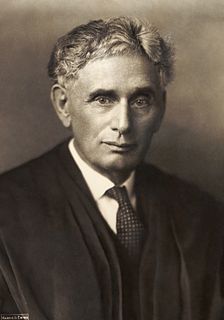

It may be laid down as a general rule, that their confidence in and obedience to a government, will be commonly proportioned to the goodness or badness of its administration . . . . Various reasons have been suggested in the course of these papers, to induce a probability that the general government will be better administered than the particular governments.