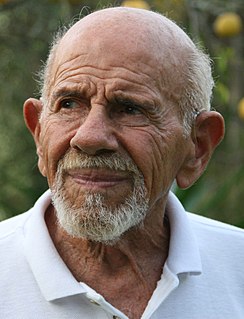

A Quote by Jacque Fresco

It's hard in a monetary system to trust people.

Related Quotes

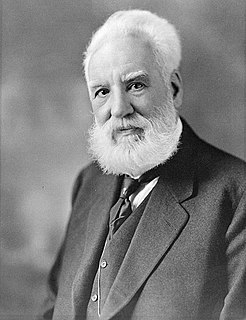

A private enterprise system needs some measuring rod, it needs something, it needs money to make its transactions. You can't run a big complicated system through barter, through converting one commodity into another. You need a monetary system to operate. And the instability in that monetary system is devastating to the performance of the economy.

In the North, neither greenbacks, taxes, nor war bonds were enough to finance the war. So a national banking system was created to convert government bonds into fiat money, and the people lost over half of their monetary assets to the hidden tax of inflation. In the South, printing presses accomplished the same effect, and the monetary loss was total.

The unique aspect of today's monetary inflation is that it is not limited to one country, but a host of countries are all inflating together. As a result of the monetary inflation (when all of the newly created money begins to leave the banks and enter the system), the price inflation will be worldwide.

The Great Depression was not a sign of the failure of monetary policy or a result of the failure of the market system as was widely interpreted. It was instead a consequence of a very serious government failure, in particular a failure in the monetary authorities to do what they'd initially been set up to do.

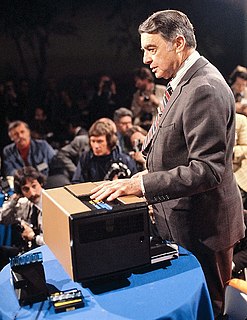

Most of what we know we don't really know first hand. I've never seen a cancer cell. But I trust this community of experts who have, so I believe that cancer exists. But we trust these experts, and we trust that the experts have a system of checks and balances and self-correction. And we have to insist that experts have certain certifications. They're not perfect. Every once in awhile there's an engine falls off the wing of a plane, or a tax audit happens and you find out your expert made a mistake. But it's a pretty good system. It's the best system we've got.

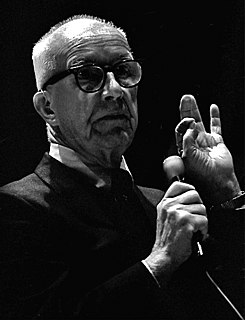

Being vulnerable is allowing yourself to trust. That's hard for a lot of people to do. They feel a lot more secure if they kind of put walls around themselves. Then they don't have to trust anybody but themselves. But to allow you to trust not only yourself but trust others means - is what's required to be vulnerable, and to have that kind of trust takes courage.