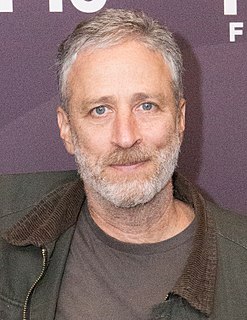

A Quote by James B. Stewart

Republicans seem to be gambling that most Americans won't care about a few rich private equity managers if their own taxes go down, their stock portfolio goes up, and economic growth accelerates.

Related Quotes

Politicians like to talk about the income tax when they talk about overtaxing the rich, but the income tax is just one part of the total tax system. There are sales taxes, Medicare taxes, social security taxes, unemployment taxes, gasoline taxes, excise taxes - and when you add up all of those taxes [many of which are quite regressive], and then you look at how they affect the rich and the poor, you essentially end up with a system in which the best off 20 percent of Americans pay one percentage point more of their income than the worst off 20 percent of Americans.

To prop up the stock price, managers have to turn down the screws on everybody. That forces them to cancel all the projects that would lead to future growth in order to drop money to the bottom line. This is HP's dilemma today. Once a company's growth has stopped, the game as we have known it is over. It's a scary thing.

As more and more Americans own shares of stock, more and more Americans understand that taxing businesses is taxing them. Regulating businesses is taxing them. They ought to be thinking long-term about their ownership, not just their income, and that they should pay taxes on capital, as well as taxes on labor.

Here’s how to know if you have the makeup to be an investor. How would you handle the following situation? Let’s say you own a Procter & Gamble in your portfolio and the stock price goes down by half. Do you like it better? If it falls in half, do you reinvest dividends? Do you take cash out of savings to buy more? If you have the confidence to do that, then you’re an investor. If you don’t, you’re not an investor, you’re a speculator, and you shouldn’t be in the stock market in the first place.

Chile has done a lot to rid itself of poverty, especially extreme poverty, since the return to democracy. But we still have a ways to go toward greater equity. This country does not have a neoliberal economic model anymore. We have put in place a lot of policies that will ensure that economic growth goes hand in hand with social justice.

President Bush announced his new economic plan. The centerpiece was a proposed repeal of the dividend tax on stocks, a boon that could be worth millions of dollars to average Americans. Well, average stock-owning Americans. Technically, Americans who own a significant amount of shares in dividend-dealing companies. Well, rich people, that's what I'm trying to say. They're going to do really well with this.

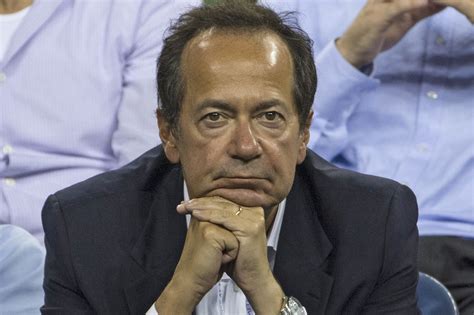

Congress has all sorts of rules, hedge fund managers, private equity managers, executives, movie stars, fall into that allow them to escape or defer into the future not paying their taxes. And if you can defer your tax into the future, it's the best deal in the world, because you don't just get to eat your cake and have it too. You get to eat your cake and have a bigger cake.