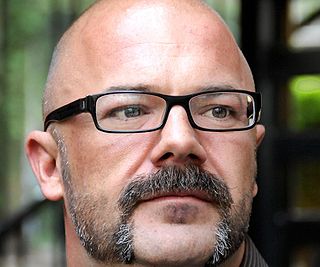

A Quote by James B. Stewart

Low-volatility funds, which tend to smooth out performance, have been especially popular since the financial crisis. The PowerShares S&P 500 Low Volatility Fund is the oldest, begun in 2011.

Related Quotes

We make too much out of past performance, and it's very misleading to investors. It causes them to move money around. They buy a fund that's hot and then it turns cold as all hot funds eventually do. And then they get out. Well, buying at the high and selling at the low isn't going to leave you a satisfied shareholder, right?

The Fed contributed to the financial crisis, keeping interest rates too low for too long. I give them credit for responding and stabilizing the economy and the financial sector during the crisis. But then they tried to do too much with quantitative easing that went on forever, just dramatically exploding their balance sheets.

We need a federal government commission to study the way our financial services system is working - I believe it is working badly - and we also need more educated investors. There are good long term low-priced mutual funds - my favorite is a total stock market index fund - and bad short term highly priced mutual funds. If investors would get themselves educated, and invest in the former - taking their money out of the latter - we would see some automatic improvements in the system, and see them fairly quickly.