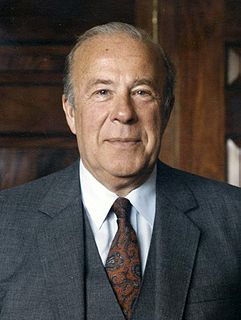

A Quote by James B. Stewart

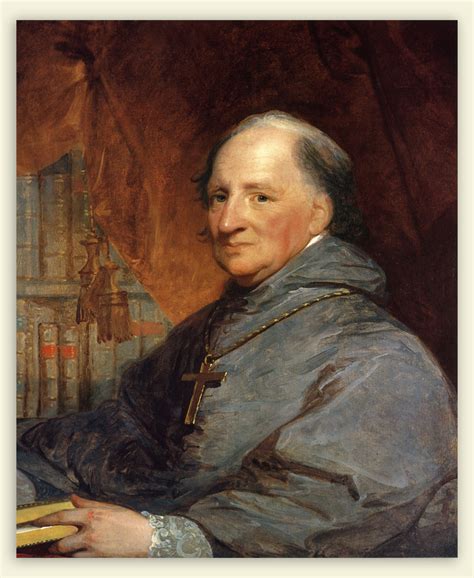

Advocates of a tax overhaul often point to the 1986 act as a model for a comprehensive approach that ushered in a long period of economic growth.

Quote Topics

Related Quotes

Growth works. What we're doing in the administration to spur growth in terms of regulatory form work. And what we're working is to make sure that those tax cuts add to that. We do believe that sustained 3 percent economic growth is possible and that that is the way you can balance the budget long-term.

The real estate lobby has prominent allies in both parties. After the last major overhaul of the tax code, in 1986 - under a Republican president, Ronald Reagan, a Republican Senate and a Democratic House - it was a Democrat, Bill Clinton, who signed legislation that restored lost real estate tax breaks seven years later.