A Quote by James Bovard

The average American family head will be forced to do twenty years' labor to pay taxes in his or her lifetime.

Related Quotes

According to the Tax Foundation, the average American worker works 127 days of the year just to pay his taxes. That means that government owns 36 percent of the average American's output-which is more than feudal serfs owed the robber barons. That 36 percent is more than the average American spends on food, clothing and housing. In other words, if it were not for taxes, the average American's living standard would at least double.

The most pernicious of his [Obama] proposals will be the massive Make Work Pay refundable tax credit. Dressed up as a tax cut, it will be a national welfare program, guaranteeing a majority of American households an annual check to 'refund' taxes they never paid. And it will eliminate the need for about 20% of American households to pay income taxes, lifting the proportion that need not do so to a majority of the voting population.

... He didn't know how to say good-bye. His throat ached from the strain of holding back his emotions. “I don't want to leave you,” he said humbly, reaching for her cold, stiff hands. Emma lowered her head, her tears falling freely. “I'll never see you again, will I?” He shook his head. “Not in this lifetime,” he said hoarsely. She pulled her hands away and wrapped her arms around his neck. He felt her wet lashes brush his cheek. “Then I'll wait a hundred years,” she whispered. “Or a thousand, if I must. Remember that, Nikki. I'll be waiting for you to come to me.

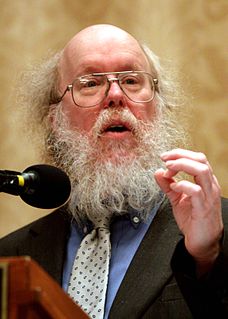

Charles Kernaghan is a legitimate American hero... Through his determination he has forced the leadership in our country and many other countries around the world to pay attention. Kernaghan has done more to expose child labor than has the whole Department of Labor that has a budget of hundreds and hundreds of millions of dollars, because he has the guts and determination to do it.

perhaps I possess a certain Midwestern sensibility that I inherited from my mother and her parents, a sensibility that Warren Buffet seems to share: that at a certain point one has enough, that you can derive as much pleasure from a Picasso hanging in a museum as from one that's hanging in your den, that you can get an awfully good meal in a restaurant for less than twenty dollars, and that once your drapes cost more than the average American's yearly salary, then you can afford to pay a bit more in taxes.

In the name of short-term stimulus, he [Obama] will give every American family (who makes less than $200,000) a welfare check of $1,000 euphemistically called a refundable tax credit. And he will so sharply cut taxes on the middle class and the poor that the number of Americans who pay no federal income tax will rise from the current one-third of all households to more than half. In the process, he will create a permanent electoral majority that does not pay taxes, but counts on ever-expanding welfare checks from the government.